California Schedule R Instructions 2020 . This schedule is used by all taxpayers who are required to apportion business income. See general information for schedule r. corporations that do business in california and other states must apportion their unitary business income using schedule r,. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the.

from www.pdffiller.com

all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. This schedule is used by all taxpayers who are required to apportion business income. corporations that do business in california and other states must apportion their unitary business income using schedule r,. See general information for schedule r. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and.

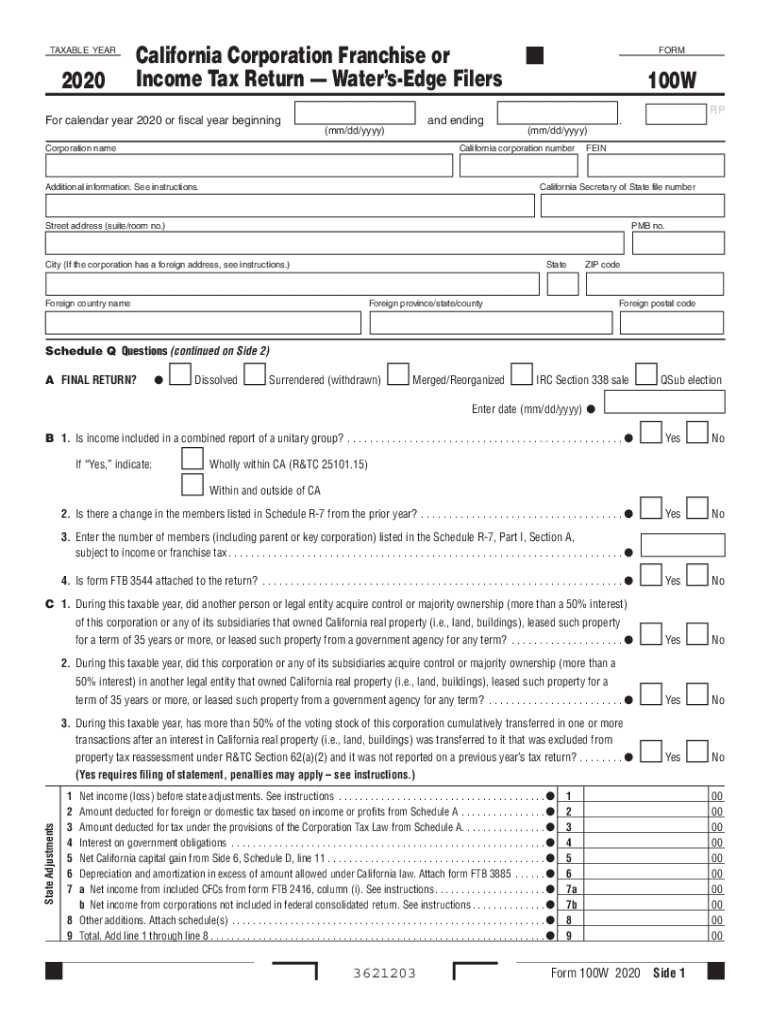

2020 Form CA FTB 100W Fill Online, Printable, Fillable, Blank pdfFiller

California Schedule R Instructions 2020 (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. corporations that do business in california and other states must apportion their unitary business income using schedule r,. This schedule is used by all taxpayers who are required to apportion business income. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. See general information for schedule r. all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),.

From www.signnow.com

565 20202024 Form Fill Out and Sign Printable PDF Template California Schedule R Instructions 2020 schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. corporations that do business in california and other states must apportion their unitary business income using schedule r,. This schedule is used by all taxpayers who are required to apportion business income. all trade or businesses, except those that derive more. California Schedule R Instructions 2020.

From www.pdffiller.com

2018 Form CA FTB 540NR Schedule CA Fill Online, Printable, Fillable California Schedule R Instructions 2020 schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. . California Schedule R Instructions 2020.

From www.templateroller.com

2020 California Apportionment and Allocation of Fill Out, Sign California Schedule R Instructions 2020 limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. corporations that do business in california and other states must apportion their unitary business income using schedule r,. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. See general information. California Schedule R Instructions 2020.

From www.signnow.com

Ca Schedule Eo Instructions 20202024 Form Fill Out and Sign California Schedule R Instructions 2020 schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. See general information for schedule r. This schedule is used by all taxpayers who are required to apportion business income. corporations. California Schedule R Instructions 2020.

From formspal.com

California Schedule R Form ≡ Fill Out Printable PDF Forms Online California Schedule R Instructions 2020 See general information for schedule r. corporations that do business in california and other states must apportion their unitary business income using schedule r,. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. limited liability companies that do business in california and other states must apportion their income using schedule. California Schedule R Instructions 2020.

From www.templateroller.com

Download Instructions for Form R Apportionment and Allocation of California Schedule R Instructions 2020 schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. (form. California Schedule R Instructions 2020.

From www.uslegalforms.com

CA FTB 540NR 20202021 Fill out Tax Template Online US Legal Forms California Schedule R Instructions 2020 See general information for schedule r. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. corporations that do business in california and other states must apportion their unitary business income using schedule r,. limited liability companies that do business in california and other states must apportion their income using schedule. California Schedule R Instructions 2020.

From formspal.com

California Schedule R Form ≡ Fill Out Printable PDF Forms Online California Schedule R Instructions 2020 (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. See general information for schedule r. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and. California Schedule R Instructions 2020.

From www.teachmepersonalfinance.com

IRS Schedule R Instructions California Schedule R Instructions 2020 See general information for schedule r. This schedule is used by all taxpayers who are required to apportion business income. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. all trade or businesses, except. California Schedule R Instructions 2020.

From www.westernstatesfinancial.com

2020 State of CA Tax Brackets Western States Financial & Western California Schedule R Instructions 2020 all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. This schedule is used by. California Schedule R Instructions 2020.

From formspal.com

California Schedule R Form ≡ Fill Out Printable PDF Forms Online California Schedule R Instructions 2020 See general information for schedule r. This schedule is used by all taxpayers who are required to apportion business income. all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. corporations. California Schedule R Instructions 2020.

From www.signnow.com

Schedule X 20202024 Form Fill Out and Sign Printable PDF Template California Schedule R Instructions 2020 corporations that do business in california and other states must apportion their unitary business income using schedule r,. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. See general information for schedule r. This schedule is used by all taxpayers who are required to apportion business income.. California Schedule R Instructions 2020.

From www.pdffiller.com

2020 Form CA FTB 100W Fill Online, Printable, Fillable, Blank pdfFiller California Schedule R Instructions 2020 limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. See general information for schedule r. all trade or businesses, except those that derive more than 50% of their gross receipts. California Schedule R Instructions 2020.

From formspal.com

California Schedule R Form ≡ Fill Out Printable PDF Forms Online California Schedule R Instructions 2020 See general information for schedule r. (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. all trade or businesses, except those that derive more than 50% of their gross receipts. California Schedule R Instructions 2020.

From www.signnow.com

540Nr Schedule D Fill Out and Sign Printable PDF Template signNow California Schedule R Instructions 2020 all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. corporations that do business in california and other states must apportion their unitary business income using schedule r,. (form 1040) department. California Schedule R Instructions 2020.

From www.pdffiller.com

20172024 Form CA FTB Schedule K1 (568) Instructions Fill Online California Schedule R Instructions 2020 all trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (qba),. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. This schedule is used by all taxpayers who are required to apportion business income. See general information for schedule r. (form 1040). California Schedule R Instructions 2020.

From www.uslegalforms.com

CA FTB Schedule CA (540) 20202022 Fill out Tax Template Online US California Schedule R Instructions 2020 This schedule is used by all taxpayers who are required to apportion business income. See general information for schedule r. schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. corporations. California Schedule R Instructions 2020.

From www.dochub.com

Schedule r Fill out & sign online DocHub California Schedule R Instructions 2020 (form 1040) department of the treasury internal revenue service (99) credit for the elderly or the disabled. This schedule is used by all taxpayers who are required to apportion business income. limited liability companies that do business in california and other states must apportion their income using schedule r, apportionment and. corporations that do business in california and. California Schedule R Instructions 2020.